While you focus on growing your business and making smart financial decisions, it’s crucial to consider the various insurance options available to protect your assets and provide financial security for your loved ones. One of the best options to explore the benefits of is whole life insurance for business owners in Canada, with a particular emphasis on the capital dividend account (CDA).

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that offers coverage for the entirety of your life (as long as the premiums are paid). Unlike term life insurance, which provides coverage for a specific period, whole life insurance combines a death benefit with an investment component. It not only protects your loved ones in the event of your passing but also builds value over time.

Deciding to structure your life insurance inside your corporation can create a significant cost savings benefit. As a Canadian business owner, you can pay insurance premiums using revenue inside your corporation. If you’re under $500,000 of net revenue, that means you’ll pay for your insurance premium with revenue that’s only been taxed at 12.2% rate (Ontario).

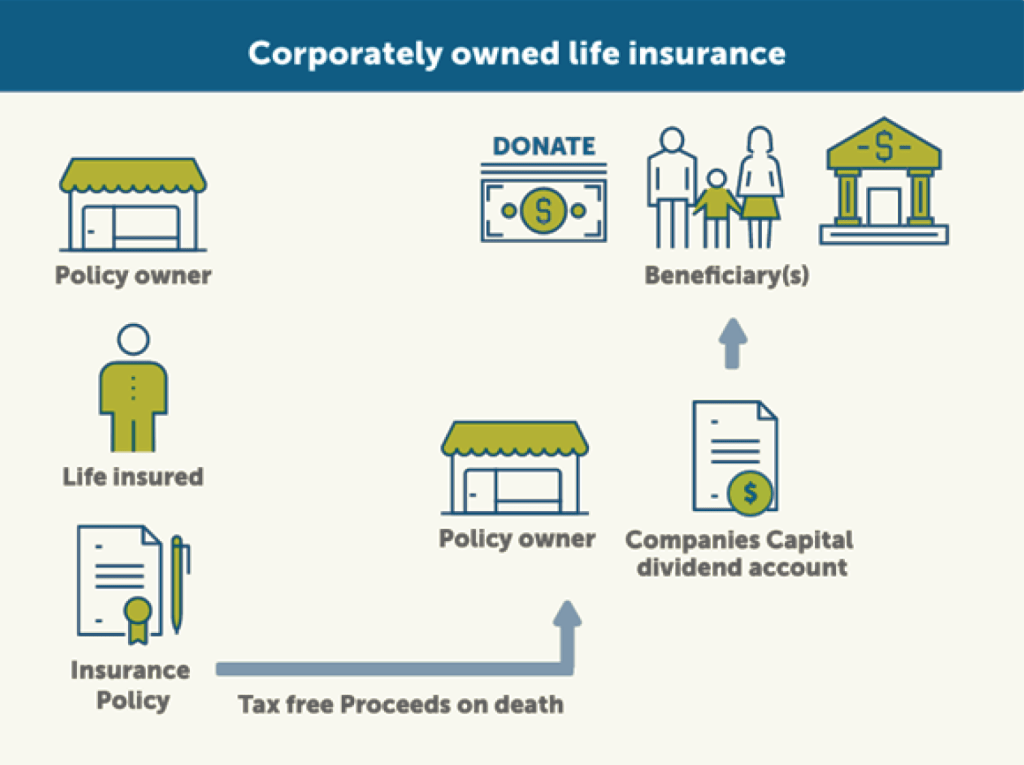

The Capital Dividend Account (CDA): One significant advantage of whole life insurance for business owners in Canada is the utilization of the capital dividend account (CDA). The CDA is a tax provision that allows tax-free capital dividends to be paid to shareholders of Canadian-controlled private corporations (CCPCs) . When a business owner holds a whole life insurance policy and dies, the death benefit can be distributed through the CDA, resulting in tax-free capital dividend to the policy’s beneficiaries – (typically shareholders of the business).

Benefits of Whole Life Insurance for Business Owners:

1. Tax Advantages: By leveraging the CDA, whole life insurance allows you to distribute the policy’s death benefit as a tax-free capital dividend to your beneficiaries ( a shareholder). This strategy can help minimize the tax burden on your estate while maximizing the wealth transfer to your loved ones.

2. Estate Planning: Whole life insurance provides an effective tool for estate planning, allowing you to pass on a tax-free inheritance to your heirs.

3. Cash Value Growth: Whole life insurance policies accumulate cash value over time. The cash value grows tax-deferred, meaning you don’t have to pay taxes on the growth while the policy is in force. It’s a good tool if you’re trying to protect against passive income. You can access this cash value through policy loans or withdrawals, providing a valuable source of funds for various business needs such as expansion, investment, or emergency funding.

4. Creditor Protection: In some provinces in Canada, the cash value of a whole life insurance policy is protected from creditors. This means that in the event of bankruptcy or legal claims, the cash value of the policy may be shielded from seizure, providing an added layer of security for your business assets.

5. Business Continuity: Whole life insurance can play a crucial role in ensuring the continuity of your business in the event of your untimely death.

The tax-free capital dividends received by shareholders can be used to cover ongoing business expenses, repay debts, or facilitate the transfer of ownership smoothly.

Add a Comment