(Source: Mackenzie Investments)

The biggest mistake

As a business owner, one of the main benefits of having a corporation is sheltering your excess profit from tax. For most small business owners this is profit that has only been taxed at a 12.2% rate so far (Ontario).

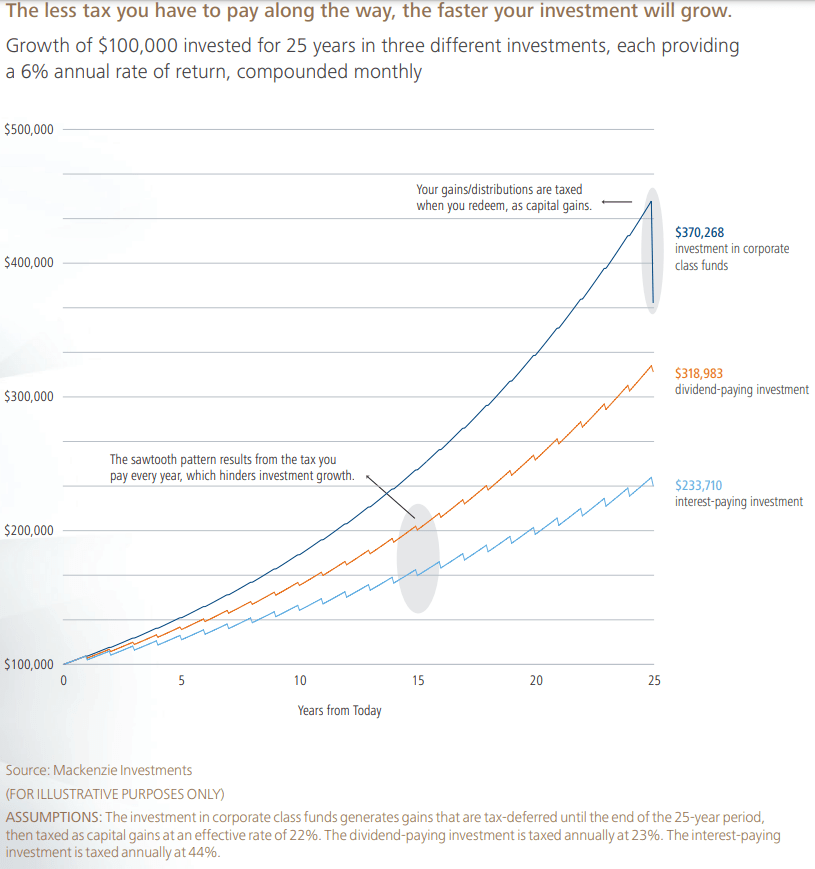

One of the biggest mistakes I see business owners (and advisors) make is what they choose to invest those profits in. If you’re building a long-term investment portfolio using corporate profits, you should focus on investments that grow and primarily generate capital gains ONLY.

What to avoid

What to avoid’ before the paragraph your portfolio consists of stocks and bonds, mutual funds and ETFs and these investments generate income inside your corporate investment account, you’re paying a ton of up-front tax and screwing with your ability to compound that wealth over time.

The worst types of income are foreign dividends and interest/income, which typically come from Global Dividend paying portfolios and funds/investments with a lot of bonds.

Conclusion

It’s crazy how much I see this ignored and how large of an impact this can have on portfolio growth over time. In fact, this can have an even greater impact on overall returns than fees.

Add a Comment